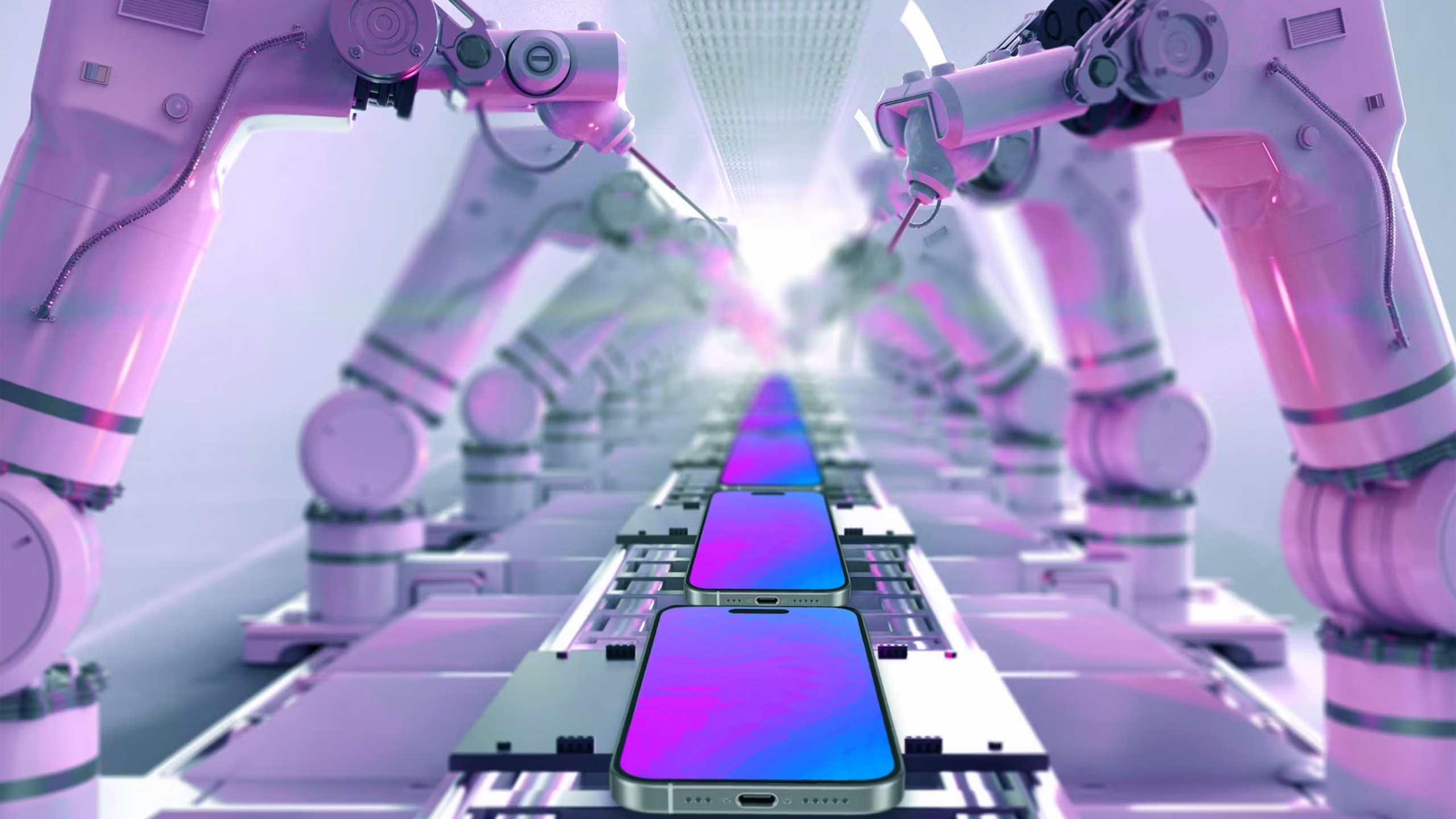

Apple’s is Producing More iPhones in India and Less in China

According to a fresh report from The Verge, Apple’s ramping up its manufacturing in India for the upcoming iPhone 17 lineup. This isn’t just a small tweak; it’s the first time all four models will roll off Indian assembly lines right from launch. With tariffs looming and geopolitical stuff heating up, it’s a smart play to spread out the risks. But is it enough to dodge all the headaches? Let’s dig in.

The Big Move to India: What’s Changing?

Apple’s been slowly but surely easing away from its heavy reliance on China for iPhone production, and this latest step cranks it up a notch. Bloomberg’s got the scoop that factories in India will handle the entire iPhone 17 family – that’s the standard, Plus, Pro, and Pro Max, I assume, though details on the exact variants aren’t spelled out. Plus, they’re gearing up for a successor to the iPhone SE (or whatever they’re calling the budget one these days), and that’ll be made in India too.

Why now? Well, it’s all about diversifying. China’s been the go-to for years because of the expertise and scale, but with trade tensions and supply chain jitters, Apple’s looking elsewhere. India’s stepping up big time, and get this: iPhones shipped from there to the US are currently exempt from those pesky tariffs. That’s a win, especially with the Trump administration slapping 50% duties on a bunch of Indian imports. But hey, things could change – Treasury Secretary Scott Bessent mentioned on CNBC that tariffs on India might go up because of their dealings with Russian oil, despite the Ukraine sanctions.

I’ve followed Apple’s supply chain sagas for a while, and this feels like a calculated hedge. They’re not ditching China entirely; subassemblies like components are still mostly coming from there, then getting final tweaks in India. Analyst Patrick Moorhead put it plainly: it “does dodge some tariffs,” but it’s not a full escape.

Tariffs, Investments, and the Broader Picture

Speaking of tariffs, Apple’s staring down a $1.1 billion hit this quarter alone from import duties. Ouch. To counter that, they’ve been pouring money into US manufacturing too – remember that $500 billion pledge earlier this year? They just tacked on another $100 billion. Trump’s even chiming in, saying companies building in the US could skip future tariffs on imported chips. If that holds, it might push more production stateside eventually.

But for now, India’s the hot spot. This shift could mean more stable supplies and maybe even lower costs long-term, assuming no major tariff hikes. It’s also good for India, boosting jobs and tech know-how. Apple’s partners like Foxconn and Tata are likely expanding ops there to make it happen. Still, challenges remain – building that expertise takes time, and any hiccups could delay launches.

Key Points from the Report

To break it down simple, here’s the main stuff you need to know:

- Full Lineup in India: All four iPhone 17 models produced in India at launch – a first for Apple.

- SE Successor Too: The next budget iPhone (successor to iPhone 16 SE?) will also be made there.

- Tariff Dodging: US-bound iPhones from India avoid current duties, but subassemblies from China might still sting.

- Potential Tariff Hikes: US eyeing higher tariffs on India over Russian oil trades, per Treasury Secretary Bessent.

- Apple’s US Push: Additional $100 billion invested in American manufacturing, on top of $500 billion earlier.

- Analyst Take: Patrick Moorhead says it helps with tariffs but isn’t a complete fix.

- Geopolitical Angle: Move reduces China dependence amid ongoing trade wars and sanctions.

These bullets capture the essence, but there’s nuance – like how this fits into Apple’s global strategy.

Apple Playing the Long Game

In the grand scheme, this is Apple playing the long game. Reducing ties to China isn’t just about tariffs; it’s about resilience. Remember the COVID lockdowns that messed up supplies? Diversifying helps avoid that. For consumers, it might not change much upfront – prices could stay steady if costs balance out. But down the line, if tariffs bite harder, we might see ripple effects on pricing or availability.

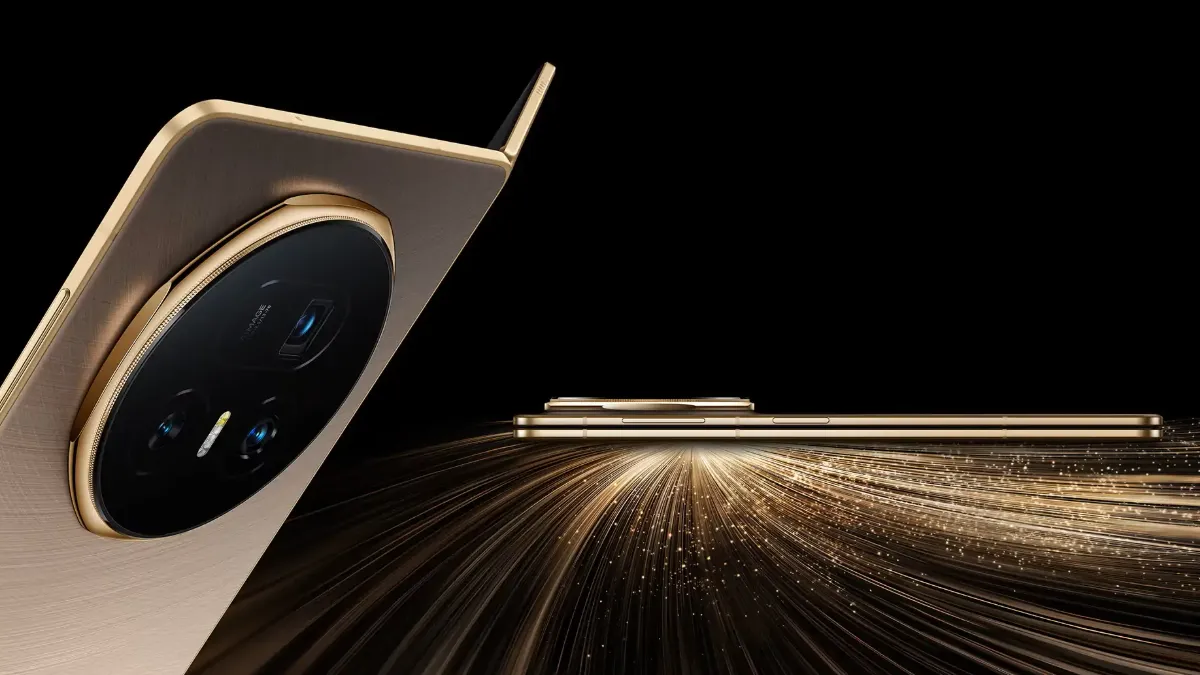

I’ve got to admit, as someone who’s upgraded iPhones more times than I care to count, it’s fascinating to see the behind-the-scenes shifts. The iPhone 17’s rumored to bring slimmer designs, better cameras, and maybe that “Air” variant for a lighter Pro Max alternative, but this report’s more about where it’s built than what’s inside. Still, production location matters – it affects everything from ethics to economics.

Trump’s comments add another layer; if US exemptions kick in, could we see more iPhones stamped “Assembled in USA”? That’d be a plot twist. For now, though, India’s in the spotlight, and it’s a sign Apple’s adapting to a world where trade’s as unpredictable as tech trends.

One thing’s for sure: Apple’s not slowing down. With launches typically in September, we’re probably months away from iPhone 17 reveals, but this production news sets the stage. If you’re eyeing an upgrade, keep tabs on how these shifts play out – might influence that next purchase.

Wrapping up, this move underscores how global events shape our gadgets. Exciting times, but a bit uncertain too. Let’s see if India becomes the new iPhone powerhouse.

Follow techzips.com for more news like this.